Starting with Index Funds for Diversification, this paragraph aims to grab the readers’ attention with a compelling overview of the topic. Diving into the world of investment diversification, index funds play a crucial role in spreading risk and maximizing returns for savvy investors.

Exploring the benefits of index funds and how they stand out among various investment options, this paragraph sets the stage for an informative discussion ahead.

Introduction to Index Funds

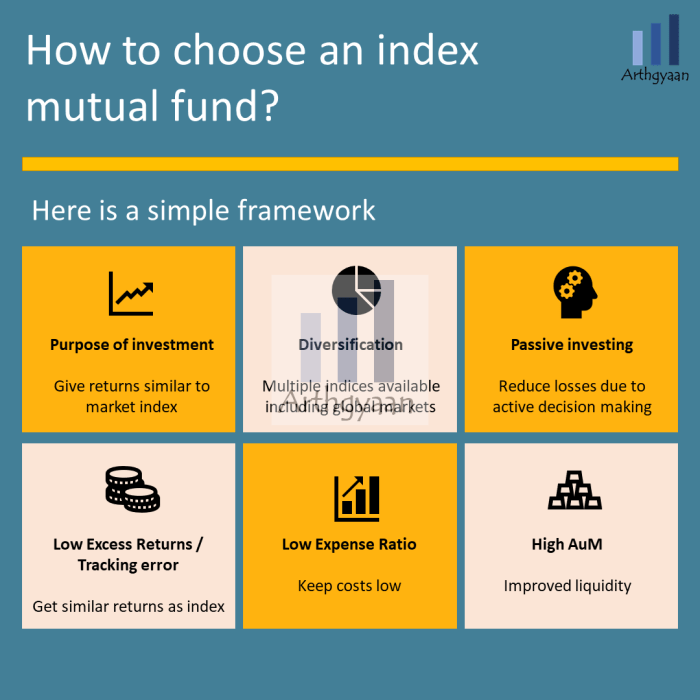

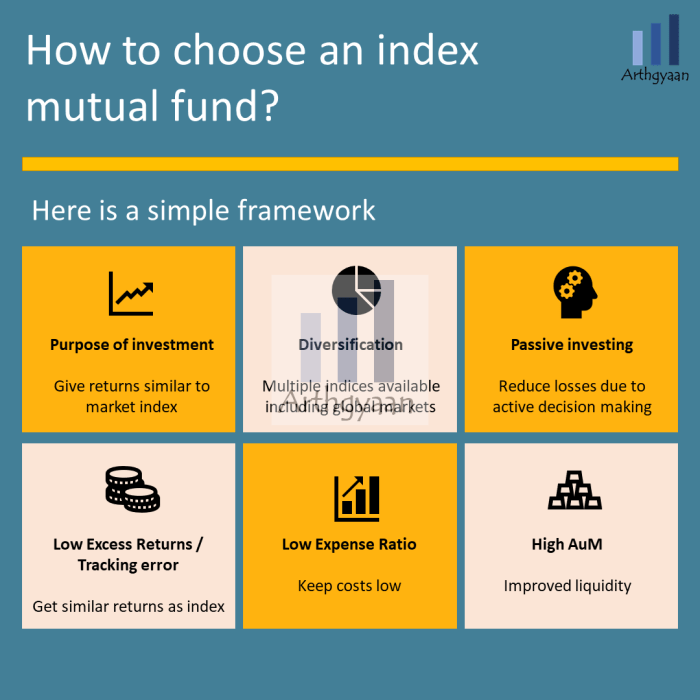

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Unlike actively managed funds, which involve a fund manager selecting individual investments, index funds passively track the components of a particular index.

Popular examples of index funds include Vanguard Total Stock Market Index Fund (VTSMX), SPDR S&P 500 ETF Trust (SPY), and iShares MSCI Emerging Markets ETF (EEM). These funds provide investors with exposure to a wide range of stocks or bonds, helping them achieve diversification in their investment portfolios.

Benefits of Investing in Index Funds for Diversification

- Low Costs: Index funds typically have lower expense ratios compared to actively managed funds, making them a cost-effective investment option.

- Diversification: By investing in an index fund that tracks a broad market index, investors can spread their risk across multiple securities, reducing the impact of individual stock or bond performance on their overall portfolio.

- Passive Management: Index funds require minimal management since they aim to replicate the performance of an index rather than actively trade securities. This can lead to lower turnover and potentially lower tax implications for investors.

- Consistent Performance: While not immune to market fluctuations, index funds have historically provided competitive returns over the long term, making them a reliable option for investors seeking steady growth.

Importance of Diversification

Diversification is a key strategy in investment portfolios that involves spreading your investments across different assets to reduce risk. By diversifying, investors can minimize the impact of volatility in any one asset or market sector, potentially leading to more stable returns over time.

How Index Funds Help Achieve Diversification

Index funds offer a simple and cost-effective way for investors to achieve diversification. These funds typically track a specific market index, such as the S&P 500, by holding a diversified portfolio of stocks or bonds that mirror the index’s performance. By investing in an index fund, investors gain exposure to a wide range of securities, spreading their risk across multiple companies and industries.

Comparing Diversification Benefits of Index Funds

When compared to other investment options, index funds provide broad diversification at a low cost. Unlike actively managed funds that aim to beat the market, index funds aim to match the performance of the underlying index. This passive approach results in lower management fees and lower turnover, making index funds an attractive choice for investors looking to diversify without taking on excessive risk.

Income Funds vs. Index Funds

When it comes to investing, it’s essential to understand the differences between income funds and index funds. Income funds and index funds have distinct investment objectives, risk-return profiles, and suitability for different situations.

Differentiation in Investment Objectives

Income funds are designed to provide investors with a steady stream of income through dividends, interest payments, or other distributions. These funds typically invest in assets like bonds, preferred stocks, and dividend-paying stocks. On the other hand, index funds aim to replicate the performance of a specific market index, such as the S&P 500. They provide broad market exposure and are passively managed.

Risk-Return Profiles

Income funds generally have lower volatility and a more conservative risk profile compared to index funds. Since income funds prioritize generating income, they tend to have more stable returns over time. On the contrary, index funds are more volatile as they aim to mirror the performance of the underlying index, which can fluctuate based on market conditions.

Situations Favoring Income Funds

Income funds may be more suitable for investors seeking regular income streams, such as retirees or those looking for a steady source of cash flow. They can be a good option for risk-averse investors who prioritize capital preservation and income generation over capital appreciation. Additionally, income funds are beneficial during periods of market uncertainty or economic downturns when preserving capital becomes crucial.

Index Funds as an Inflation Hedge

Index funds can serve as an effective hedge against inflation due to their diversified nature and ability to mirror the performance of the overall market. As inflation erodes the purchasing power of money over time, investors seek ways to protect their portfolios from the negative impacts of rising prices.

Correlation between Index Funds and Inflation Rates

Index funds are often positively correlated with inflation rates, meaning that as inflation rises, the value of the assets within the index fund may also increase. This correlation can help investors mitigate the effects of inflation on their investment returns.

Strategies for Using Index Funds to Protect Portfolios from Inflation

- Diversification: By investing in a variety of assets through an index fund, investors can spread their risk and potentially offset the impact of inflation on any single asset.

- Choose Inflation-Resistant Sectors: Investing in sectors that historically perform well during inflationary periods, such as commodities or real estate, can help protect a portfolio from the effects of rising prices.

- Consider TIPS: Treasury Inflation-Protected Securities (TIPS) are bonds specifically designed to protect against inflation. Including TIPS in an index fund portfolio can provide an additional layer of protection.

- Regularly Rebalance: Periodically rebalancing an index fund portfolio can help ensure that it remains aligned with investment goals and risk tolerance, which is especially important during times of inflation.

Index Funds and Insurance Premiums

Investing in index funds can have an impact on insurance premiums due to the potential returns and risks associated with these investments. Insurance companies also use index funds as part of their investment strategies to help manage their overall portfolio.

Insurance Premiums and Index Funds

Insurance premiums are the amount of money that individuals or businesses pay to insurance companies in exchange for coverage against potential risks or losses. The premiums are calculated based on various factors, including the level of risk associated with the insured individual or property.When individuals invest in index funds, they have the opportunity to earn returns based on the performance of a specific index, such as the S&P 500.

These returns can potentially increase the overall wealth of the investor, which may impact their insurability and the cost of insurance premiums.Moreover, insurance companies themselves often invest a portion of their assets in index funds to diversify their investment portfolio and potentially earn higher returns. By using index funds, insurance companies can spread their risk across a broad range of assets and potentially mitigate losses in case of market downturns.Overall, the relationship between index funds and insurance premiums is complex and depends on various factors, including the performance of the index fund, the risk profile of the insured individual or property, and the investment strategies of insurance companies.

Wrapping up the discussion on Index Funds for Diversification, it’s clear that these funds offer a reliable way to achieve a well-rounded investment portfolio. By tapping into the power of diversification through index funds, investors can secure their financial future with confidence.

Quick FAQs

Are index funds suitable for beginners?

Yes, index funds are often recommended for beginners due to their low fees, diversification benefits, and simplicity.

Can index funds guarantee profits?

No, index funds do not guarantee profits as they are subject to market fluctuations. However, they offer a more stable and diversified investment option.

How do index funds compare to actively managed funds?

Index funds typically have lower fees and aim to mimic the performance of a specific market index, while actively managed funds involve higher fees and attempt to outperform the market through strategic investments.

What is the minimum investment required for index funds?

The minimum investment required for index funds can vary depending on the fund provider, but some funds have low minimum investment requirements, making them accessible to a wide range of investors.

Are index funds a good long-term investment?

Yes, index funds are often considered good long-term investments due to their ability to provide consistent returns over time and their role in diversifying a portfolio.