Embark on a journey into the world of Index Funds with the Best Returns, where lucrative investment opportunities await those seeking long-term growth and financial stability. Explore the ins and outs of index funds and uncover the secrets to maximizing returns in this dynamic market.

Delve into the key factors influencing returns, compare index funds to income funds, discover their role as an inflation hedge, and unravel their impact on insurance premiums. Get ready to revolutionize your investment strategy with this comprehensive guide.

Understanding Index Funds

Index funds are investment funds that track a specific market index, such as the S&P 500 or the Nasdaq. They work by holding a diversified portfolio of assets that mirror the components of the chosen index. This passive investment approach aims to replicate the performance of the index it tracks.

Investing in index funds provides investors with a way to gain exposure to a broad range of securities across various industries and sectors without the need for active management. This strategy offers a cost-effective and efficient means of diversification, making it an attractive option for long-term investors looking to achieve steady growth over time.

Popular Index Funds with the Best Returns

Some popular index funds known for delivering consistent returns include:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Schwab S&P 500 Index Fund (SWPPX)

- iShares Russell 2000 ETF (IWM)

By investing in these well-established index funds, investors can benefit from broad market exposure and potentially achieve competitive returns over the long term.

Benefits of Investing in Index Funds for Long-Term Growth

Investing in index funds offers several advantages for long-term growth, including:

- Diversification: Index funds provide exposure to a wide range of assets, reducing individual stock risk.

- Low Costs: Passive management typically results in lower fees compared to actively managed funds.

- Consistent Performance: Index funds aim to replicate the performance of the underlying index, offering steady returns over time.

- Easy Accessibility: Index funds are widely available and easy to invest in, making them suitable for both novice and experienced investors.

Factors Influencing Returns

Investing in index funds can offer a simple and effective way to diversify your portfolio and achieve long-term returns. However, several key factors can influence the returns you receive from these funds.Market Conditions:The performance of index funds is heavily influenced by market conditions. Factors such as economic indicators, interest rates, geopolitical events, and overall market sentiment can all impact the returns generated by index funds.

During periods of economic growth, index funds tend to perform well, while in times of economic uncertainty or recession, returns may be lower.Diversification:Diversification plays a crucial role in maximizing returns from index funds. By investing in a broad range of assets within an index, investors can spread out risk and reduce the impact of volatility on their overall returns. Diversification helps to offset losses in one sector with gains in another, providing a more stable and consistent return over time.

Role of Diversification in Maximizing Returns

Diversification is a strategy that involves spreading investments across different asset classes, industries, and regions to reduce risk. In the context of index funds, diversification is achieved by holding a variety of securities that make up the index being tracked. This approach helps investors avoid putting all their eggs in one basket and increases the likelihood of capturing the overall market returns.

- Diversification lowers the impact of individual stock performance on the overall return of the index fund.

- It helps minimize the risk of large losses by spreading investments across a wide range of assets.

- By investing in different sectors and industries, diversification ensures that investors are not overly exposed to the performance of a single market segment.

- Over time, diversification can lead to more stable and predictable returns, reducing the impact of market volatility.

Comparing Index Funds vs. Income Funds

When it comes to investing, it’s essential to understand the differences between index funds and income funds. Index funds are designed to track a specific market index, such as the S&P 500, providing broad market exposure with low fees. On the other hand, income funds focus on generating regular income through dividends, interest payments, or capital appreciation.

Differentiating Index Funds and Income Funds

Index funds offer diversification and typically have lower management fees compared to actively managed funds. They aim to mirror the performance of a specific market index, making them a popular choice for long-term investors seeking broad market exposure. In contrast, income funds prioritize generating income for investors through regular dividend payments or interest income. These funds may hold a mix of stocks, bonds, or other income-generating securities.

Potential Returns and Risks

- Index funds: Historically, index funds have shown consistent returns over the long term, closely mirroring the performance of the underlying index. While they offer the potential for steady growth, they may be susceptible to market volatility.

- Income funds: Income funds focus on generating regular income for investors, making them ideal for those seeking a steady cash flow. However, they may carry higher risk compared to index funds, especially if interest rates rise or if the underlying assets perform poorly.

Examples of Income Funds and Historical Performance

Some examples of income funds include Vanguard High Dividend Yield Index Fund (VHYAX), PIMCO Income Fund (PONAX), and Fidelity Strategic Dividend & Income Fund (FSDIX). These funds have historically provided investors with a steady income stream through dividends and interest payments. However, it’s essential to consider the specific investment objectives, risks, and past performance of each fund before investing.

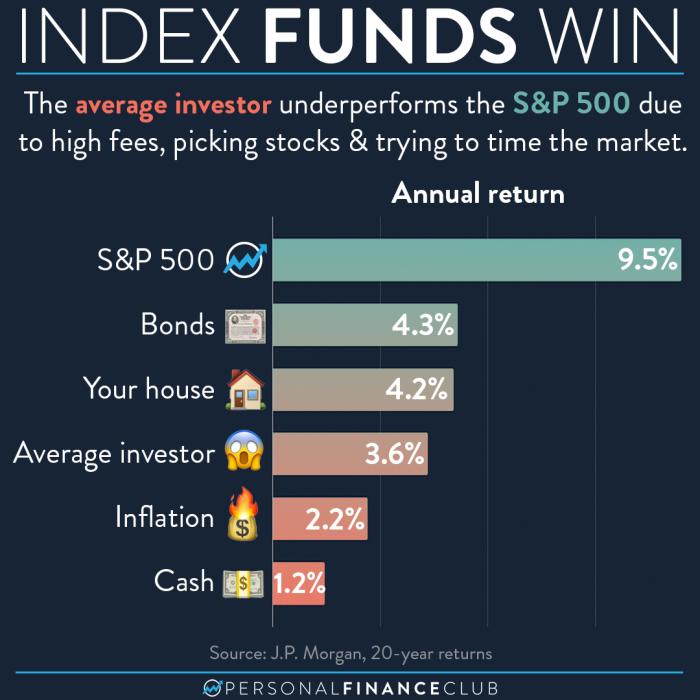

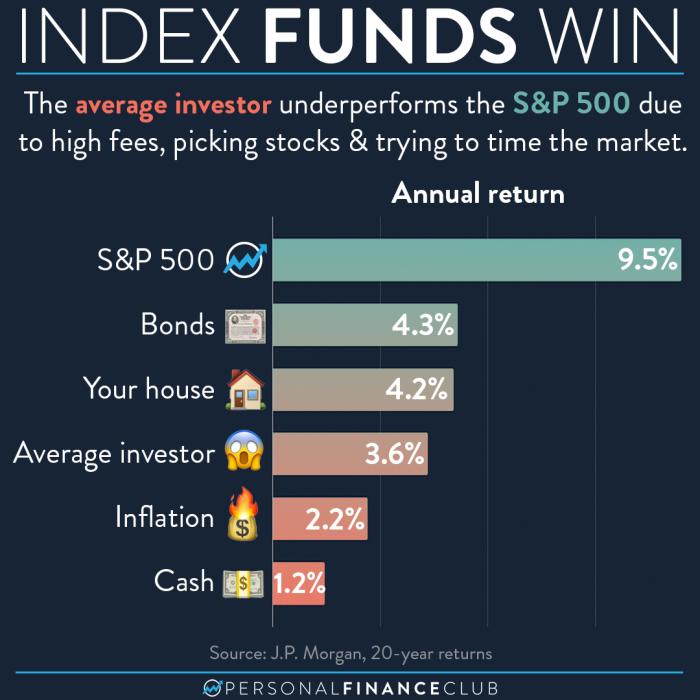

Index Funds as an Inflation Hedge

Index funds can serve as an effective hedge against inflation due to their diversified nature and ability to track the performance of an entire index, such as the S&P 500. Inflation erodes the purchasing power of money over time, but investing in index funds can help investors maintain the real value of their assets.

Relationship Between Inflation and Index Fund Performance

Index funds tend to perform well during periods of inflation as they hold a wide range of assets that can benefit from rising prices. Stocks, which make up a significant portion of index funds, have historically outperformed inflation over the long term. Additionally, companies within these indexes often have the ability to increase prices in line with inflation, thereby protecting investors’ returns.

- Index funds can include inflation-resistant assets such as real estate investment trusts (REITs) or commodities like gold, which tend to perform well during inflationary periods.

- As inflation rises, the prices of assets held within index funds also tend to increase, leading to higher returns for investors.

- Index funds provide a passive investment approach, making them a convenient way to hedge against inflation without the need for active management.

Index Funds and Insurance Premiums

Investing in index funds can have an impact on insurance costs due to the correlation between the two. Insurance companies often utilize index funds in their investment strategies, which can in turn affect the premiums paid by policyholders.

Utilization of Index Funds by Insurance Companies

Insurance companies often invest a portion of their assets in index funds to achieve diversification and potentially higher returns. By spreading their investments across a broad range of stocks or bonds represented in an index, they aim to reduce risk and increase the overall value of their portfolio.

- Index funds provide insurance companies with exposure to a wide range of securities without the need for active management, which can help lower investment costs.

- By tracking a specific index, insurance companies can benefit from the overall performance of the market or a particular sector, potentially leading to higher returns.

- Insurance companies may use index funds as part of their overall investment strategy to balance risk and return, aligning with their long-term financial goals.

In conclusion, Index Funds with the Best Returns offer a promising avenue for investors to secure substantial profits and safeguard against market fluctuations. By understanding the intricacies of these funds and leveraging their potential, you can pave the way for a financially secure future. Dive into the world of index funds today and watch your investments soar to new heights.

FAQ Section

How do index funds differ from traditional mutual funds?

Index funds track specific market indexes, while mutual funds are actively managed by fund managers.

Can investing in index funds protect against inflation?

Yes, index funds can serve as a hedge against inflation by offering diversified exposure to various assets.

What are some examples of popular index funds known for their high returns?

Examples include Vanguard Total Stock Market Index Fund and SPDR S&P 500 ETF Trust.