Starting with Income Funds for Monthly Payouts, this introductory paragraph aims to grab the readers’ attention and provide a glimpse of what’s to come.

Exploring the world of income funds and how they can benefit you financially will be the focus of this discussion.

Income Funds for Monthly Payouts

Income funds are investment vehicles that are specifically designed to provide investors with regular income payouts on a monthly basis. These funds typically invest in a diversified portfolio of income-generating assets such as bonds, dividend-paying stocks, real estate investment trusts (REITs), and other fixed-income securities.Investing in income funds can be beneficial for individuals looking to supplement their regular income streams or retirees seeking a steady source of income in retirement.

By investing in income funds, investors can enjoy the convenience of receiving monthly payouts without having to actively manage their investments.

Types of Assets in Income Funds

Income funds typically invest in a variety of assets to generate monthly payouts. These assets may include:

- Corporate bonds

- Government bonds

- Preferred stocks

- High-dividend stocks

- REITs

These assets are chosen for their ability to generate consistent income, which is then distributed to investors in the form of monthly payouts.

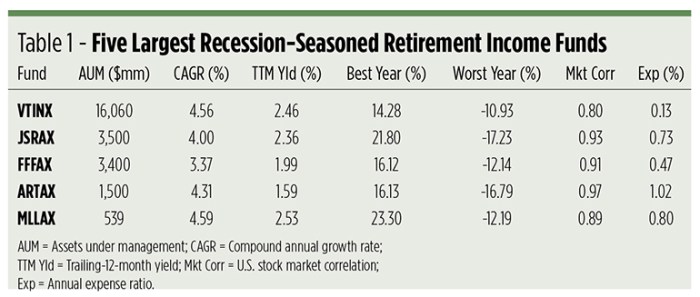

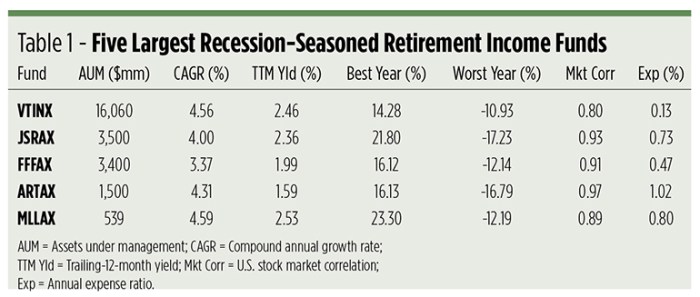

Popular Income Funds Offering Monthly Payouts

- Vanguard High Dividend Yield Index Fund (VHYAX)

- Fidelity Strategic Dividend & Income Fund (FSDIX)

- PIMCO Income Fund (PONAX)

- Schwab Monthly Income Fund (SWJRX)

These are just a few examples of income funds that offer monthly payouts to investors, providing a reliable source of income over time.

Index Funds for Diversification

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to track a specific market index, such as the S&P 500. These funds are passively managed, meaning they replicate the performance of the underlying index rather than trying to outperform it like actively managed funds.

Advantages of Investing in Index Funds

- Low Costs: Index funds have lower expense ratios compared to actively managed funds, which can help maximize returns over the long term.

- Diversification: By tracking a broad market index, investors gain exposure to a wide range of companies, reducing individual stock risk.

- Consistent Performance: Index funds tend to perform in line with the overall market, providing a stable investment option for long-term growth.

Comparison with Other Investment Options

- Performance: Studies have shown that index funds often outperform actively managed funds over the long term due to lower costs and consistent returns.

- Risk Management: Index funds offer a diversified portfolio, reducing the impact of market volatility on individual holdings.

- Accessibility: Index funds are easy to buy and sell, making them a convenient option for both novice and experienced investors.

Tips for Choosing the Right Index Funds

- Consider Your Goals: Determine your investment objectives and risk tolerance to select index funds that align with your financial goals.

- Expense Ratios: Look for index funds with low expense ratios to minimize costs and maximize returns.

- Track Record: Research the historical performance of index funds to gauge their consistency and reliability over time.

Inflation Hedge with Investment Funds

In the context of investment funds, an inflation hedge refers to an investment strategy that aims to protect investors’ purchasing power from the effects of rising prices or inflation over time. Income funds can serve as an effective hedge against inflation due to their focus on generating regular income through dividends or interest payments. These funds typically invest in assets like dividend-paying stocks, bonds, or real estate investment trusts (REITs) that have the potential to provide a steady stream of income regardless of market conditions.

Strategies to Protect Against Inflation

Income fund managers employ several strategies to protect investors’ purchasing power against inflation. Some common strategies include:

- Investing in inflation-protected securities: Income funds may allocate a portion of their portfolio to Treasury Inflation-Protected Securities (TIPS) or other inflation-indexed bonds that adjust their principal value based on changes in inflation.

- Diversification: By holding a mix of assets with varying correlations to inflation, such as commodities, real estate, and infrastructure investments, income funds can help offset the impact of inflation on the overall portfolio.

- Adjusting asset allocation: Fund managers may adjust the fund’s asset allocation over time to respond to changing inflation expectations, shifting towards assets that tend to perform well in inflationary environments.

- Active management: Through active monitoring of economic indicators and market conditions, fund managers can make strategic investment decisions to navigate inflationary pressures and protect investors’ purchasing power.

Examples of Inflation-Resistant Income Funds

Some income funds that have historically performed well as inflation hedges include:

- Vanguard Inflation-Protected Securities Fund (VIPSX): This fund invests in TIPS and other inflation-protected bonds to provide investors with a hedge against inflation while generating income.

- PIMCO Real Return Fund (PRRIX): Managed by PIMCO, this fund focuses on inflation-linked bonds and other assets to help investors preserve their purchasing power in inflationary environments.

- T. Rowe Price Real Assets Fund (PRAFX): This fund invests in real assets like commodities, natural resources, and real estate securities, offering investors diversification and protection against inflation.

Insurance Premiums and Investment Funds

Investing in income funds can have a significant impact on covering insurance costs. The relationship between insurance premiums and investment funds is crucial in managing financial goals and protecting against risks. By strategically allocating funds, individuals can balance insurance expenses with investment objectives effectively.

Role of Dividends from Income Funds

Dividends from income funds play a vital role in offsetting insurance premium payments. These regular payouts provide a steady income stream that can be used to cover various expenses, including insurance costs. By reinvesting dividends or using them to supplement cash flow, investors can optimize their financial resources.

Strategic Allocation of Funds

When it comes to balancing insurance expenses with investment goals, a strategic allocation of funds is key. By diversifying investments across different asset classes, including income funds, individuals can create a robust financial portfolio that can help mitigate risks and generate consistent returns. Allocating a portion of funds specifically for insurance premiums ensures that these essential costs are covered without compromising long-term investment objectives.

In conclusion, Income Funds for Monthly Payouts offer a reliable way to generate regular income streams and secure your financial future.

Frequently Asked Questions

How do income funds generate monthly payouts?

Income funds typically invest in dividend-paying stocks, bonds, or real estate investment trusts (REITs) to generate regular income distributed to investors.

What are the benefits of investing in income funds for regular income streams?

Investing in income funds provides a steady source of income, diversification, and potential capital appreciation over time.

Can income funds act as an inflation hedge?

Yes, income funds can serve as an effective hedge against inflation by investing in assets that tend to perform well during inflationary periods.

How can income funds help cover insurance costs?

Income funds can potentially help cover insurance costs by providing regular payouts that can be used to offset premium payments.